Do you have a bank account and buy mutual funds through your bank? If yes, you need to read this article to save money and make smarter investment decisions. Many investors are unaware of the hidden costs associated with buying mutual funds through banks. Let’s dive into the details and explore why you should think twice before signing up for regular mutual funds offered by your bank.

The Commission Game: How Banks Earn Crores from Mutual Funds

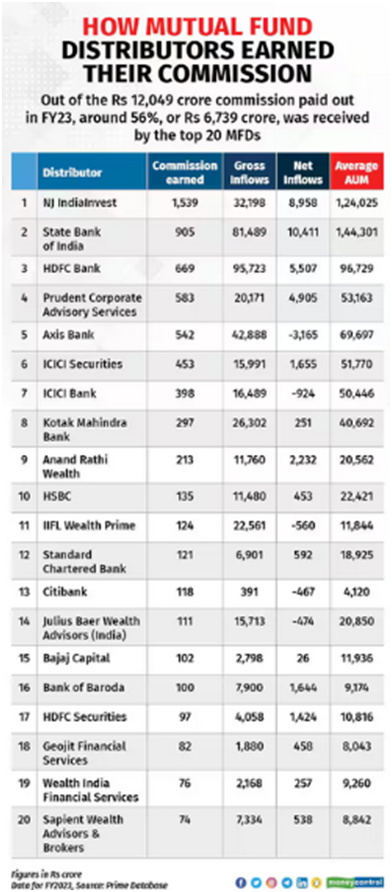

In the financial year 2023, mutual fund distributors (MFDs) earned a whopping Rs 12,049 crore in commissions. Out of this, the top 20 MFDs alone pocketed around 56%, or Rs 6,729 crore. Banks like State Bank of India (SBI), HDFC Bank, and Axis Bank are among the top earners. For instance, SBI earned Rs 905 crore in commissions, while HDFC Bank made Rs 669 crore.

These commissions are not just a small fee; they are baked into the expense ratio of regular mutual funds. This means that every time you invest in a regular mutual fund through your bank, a portion of your returns is being siphoned off to pay these commissions. Over time, this can significantly reduce your overall returns.

Regular Funds vs. Direct Funds: What’s the Difference?

When you buy mutual funds through a bank or a distributor, you are typically investing in regular funds. These funds have higher expense ratios because they include the distributor’s commission. On the other hand, direct funds are those that you can buy directly from the mutual fund company, bypassing the distributor. Since there’s no middleman involved, the expense ratio is lower, which means higher returns for you.

For example, the extra expenses in regular funds can range between 0.4% to 1% depending on the fund chosen. While this might seem like a small percentage, over the long term, it can add up to a significant amount. Let’s say you invest Rs 10 lakh in a mutual fund with an expense ratio that is 1% higher than a direct fund. Over 20 years, this could result in a difference of several lakhs in your returns.

Why Do Banks Push Regular Funds?

Banks and financial advisors often recommend regular funds because they earn a commission from them. This commission is part of their revenue stream, and it’s in their interest to promote these funds. However, this doesn’t necessarily mean that regular funds are bad. If your bank executive is providing valuable advice and helping you manage your portfolio, the extra cost might be worth it. But if you’re simply buying mutual funds based on the bank’s recommendation without understanding the implications, you could be losing out on higher returns.

The Case for Direct Funds

Direct funds are a great option for investors who are willing to do a bit of research and manage their investments themselves. By cutting out the middleman, you can save on the extra costs and keep more of your money. Over the long term, this can lead to significantly higher returns.

For example, if you invest Rs 10,000 per month in a direct fund with an expense ratio of 0.5% instead of a regular fund with an expense ratio of 1.5%, the difference in returns over 20 years could be substantial. The expected return is 12%

Using the future value of SIP formula:

Regular Fund: Your investment grows to approximately ~ ₹81L

Direct Fund: Your investment grows to approximately ~ ₹92.5 L

That’s a difference of ₹11.5 lakhs! By simply opting for a direct fund, you could save a significant amount of money over the long term. This example clearly shows how small differences in expense ratios can have a big impact on your wealth creation.

What About Smaller MFDs?

If you prefer to have some guidance but want to avoid the high commissions charged by big banks, you can consider smaller mutual fund distributors (MFDs). These MFDs are often more reachable and may offer personalized services. They might charge lower commissions, making them a more cost-effective option compared to big banks.

Taking Control of Your Investments

The bottom line is that you should not sign and purchase mutual funds blindly. Understand the costs involved and make informed decisions. If you’re comfortable managing your investments, consider switching to direct funds to save on costs and maximize your returns. If you prefer professional advice, look for advisors who offer value for money and are transparent about their fees.

Conclusion

Investing in mutual funds is a great way to grow your wealth, but it’s important to be aware of the hidden costs. By understanding how mutual fund distributors earn their commissions and the impact on your returns, you can make smarter investment choices. Whether you choose to go direct or work with a smaller MFD, the key is to take control of your investments and ensure that you’re not paying unnecessary fees.

Start investing directly today and take a step towards financial freedom. Remember, every percentage point saved in fees is a percentage point earned in returns. This is not an investment advice, kindly consult your registered financial advisor.

#MutualFunds

Test